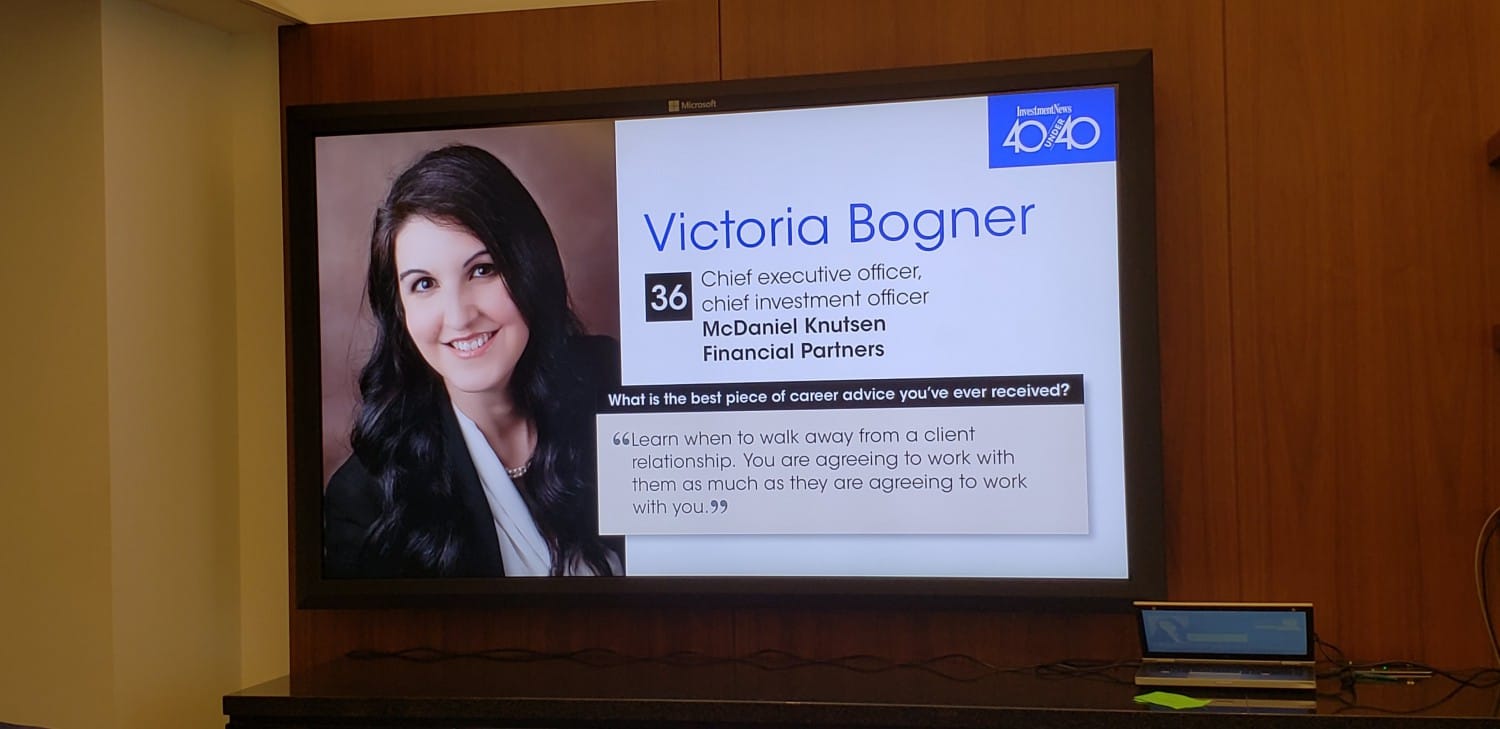

Meet Victoria Bogner, the CEO of McDaniel Knutson Financial & Affinity Financial Advisors and a Financial Planner in Cetera Advisor Networks LLC. She works with a wide array of clients that range from university presidents to Hollywood celebrities. Honoree by Investment News as one of 40 under 40, for her talent doing remarkable things in the financial advice industry in the USA, she is also a mom & wife.

Who is Victoria Bogner?

I’m a Christian, a mom, a daughter, a friend, a wife, and a CEO. But mostly I’m a scrappy little girl from small-town Kansas.

You grew up in a trailer park, you were the first in your family to attend college, in this context, how was Victoria as a kid? what did you learn for that difficult childhood?

As a kid, I was very shy. I was that clumsy kid that was picked last for everything. But I’d like to think that made me resilient in the face of rejection and adversity. It also gives me an enormous amount of empathy for single parents. It’s hard raising kids on your own, and while my mom had her struggles, she did a great job with the resources she had. She won her own battles and showed me what it meant to be strong.

You have a Bachelor's degree of Science in Mathematics and State University, a Minor in Computer Science and Japanese studies at Kansas State University, why did you study that?

Originally, I wanted to work for the National Security Agency(NSA) as a cryptologist. Then I met my future husband, and a career with the NSA and having a family doesn’t go together very well. At that point, I found myself with a strange mix of degrees without a plan of what to do with them. I decided to try my hand at being an actuary but was never hired for that particular job. After college, I started temping wherever I could find work. Through a wonderfully strange turn of events, McDaniel Knutson asked me to temp for them to clean up their database. That was back in 2005, and I just never left!

You joined the McDaniel Knutson team in 2005 and work with a wide array of clients that range from university presidents to Hollywood celebrities. An Accredited Investment Fiduciary® and a Certified Financial Planner®, also a Chartered Financial Analyst Charterholder, how did you jump from that point to become the Chief Executive Officer of McDaniel Knutson Financial?

– After the McDaniel Knutson team got to know me a bit, they asked me to join them full-time as an advisor. At that point, I knew nothing about the financial markets. I didn’t even know what a mutual fund was. But I thought I’d give it a shot. What intrigued me the most was our investment management. With my math degree and statistics background, the probabilities contained inside the movements of the stock market fascinated me. I immediately joined the investment committee and started contributing to my math background. Eventually, when the investment manager retired, I was asked to take over the role. I started to grow in my responsibilities to the point that when the CEO retired, I was asked to take the helm of the firm. It’s pretty amazing to look back and see where I started. Literally at the bottom rung!

"Don’t underestimate anyone or anything. Be extremely intentional about what you do and why. Find someone who is where you want to be and emulate how they got there. You don’t have to reinvent the wheel"

For the people who are not experts in the financial sector, can you tell us in a simple language, what services does McDaniel Knutson offer? for what kind of clients and what does it make unique in the sector?

McDaniel Knutson helps clients fulfill their dreams and goals through creative financial strategies. Our hope is also to inspire philanthropy since that is one of our main pillars. We offer financial plans to make sure that you’re on track to meet your goals, and if you’re not, some simple steps in how to get there. We also manage investment assets and have strategic partnerships with other professionals to help you with your entire picture, such as your estate, health insurance, home, and auto insurance, and even your fitness!

With Affinity Financial Advisors, we take all of the amazing tools we built for ourselves and all of our strategic partnership and offer that to another advisor to use. We’re a co-op, sharing services so we can all Benefit.

You have advised Hollywood celebrities as part of your job, do you think it is more difficult to work with them for the fact they are famous and some of them, are known for being very capricious?

I’m very specific about who I will work with. If someone has unrealistic expectations, I don’t take them as a client. The actors that I work with are delightful. They’re humble, down to earth, generous, and kind. I can’t say enough good things about them!

You are the CEO of McDaniel Knutson Financial & Affinity Financial Advisors and a Financial Planner in Cetera Advisor Networks LLC, you are also a past president of your local chapter of the National Association of Insurance and Financial Advisors, founder and current CFO of the Johnson County Business Partners, a networking group for building businesses. In 2018, you were selected by The InvestmentNews as one of 40 Under 40, a project that shines a spotlight on the tremendous potential in the financial advice industry by finding often unrecognized young talent doing remarkable things, what´s the recipe of your success?

I would say that I’m lucky, but people who seem lucky are simply prepared for when an opportunity presents itself. I’m willing to help wherever I can, even if that means taking out the trash or making a fresh pot of coffee, and having that mindset, always looking for ways to help and make others’ lives easier, really comes full circle. You learn skills you wouldn’t have otherwise, meet people you never would have met any other way, and make unique connections. Then suddenly, you’ll wake up and find that by lifting everyone else up, you lifted yourself up at the same time!

Tell us more about the award you got recently, the Excellence in Finance Technology, was it personal or a company award?

This was an award specifically given for technology in finance, and my company received it because we have created some really cutting edge tech when it comes to taking care of clients. Our tech is actually the biggest reason most advisors want to use our platform! There’s nothing else like it that I’ve seen in the industry, and it makes it easy for an advisor to stay on top of the entire story of a client’s financial life. That makes them better advisors, which in turn benefits their clients. It’s a win-win-win.

What is the reality of your day-to-day?

I wear a lot of hats, so each day is a little different. But I get my kids ready in the morning, drive to work, meet with clients, talk with other advisors about how we can make their lives better, talk with my staff to see what they’re working on and if they need help, analyze the market and each of our models’ holdings, then drive home to cook dinner.

"Be solid on your ‘why’ and your overarching goals. If you know those two things, just ask yourself, “Will this further my goals?” Then decisions practically make themselves. Remember that success isn’t about getting things done, it’s about getting important things done"

Do you have any particular philosophy that guides your career decisions?

Be solid on your ‘why’ and your overarching goals. If you know those two things, just ask yourself, “Will this further my goals?” Then decisions practically make themselves. Remember that success isn’t about getting things done, it’s about getting important things done.

If you could, would you change any steps you took in your career, and if so, what would you change?

Even though saying ‘yes’ has gotten me to where I am, I could have said ‘no’ more often to have balance in my life. My career success sometimes came at the expense of my family, and I’m not happy about that. Balance is really hard. I would have said no to some board positions that were a lot of time and responsibility. I would have said yes to having kids sooner because I didn’t know how much of a joy they would be. I would have gone on more dates with my husband. Fortunately, it’s not too late, I can still do those things!

What do you love most about your job as CEO? what is the most difficult part?

I love having the ability to see the vision of the company and take steps toward making it a reality. At the same time, it’s a huge responsibility. A lot of people depend on me, and when something I try fails, I can be too hard on myself.

As an entrepreneur, what is the one thing you do over and over and recommend everyone else does?

There are a few, but the most important ones are to have a morning routine, set small goals to accomplish for the day and big ones to accomplish for long-term, never ask anyone to do something you’re not willing to do yourself, stay humble, and learn to be extremely efficient. Work in your sweet spot. Don’t waste time worrying. Take breaks to give your brain a chance to work out problems on its own. The best ideas happen right before you fall asleep.

What is one strategy that has helped you grow your business?

Don’t underestimate anyone or anything. Be extremely intentional about what you do and why. Find someone who is where you want to be and emulate how they got there. You don’t have to reinvent the wheel.

You are a very busy woman and also you have collaborated in several companies as a volunteer, what drives you to do that?

I have been blessed with more than I deserve, and I want to be able to give back. If I can’t spend time on this earth lifting other people up, what am I here for? I want to be an example to my kids that it’s not about us, it’s about how we can help others. And always be grateful.

"Balance is a bit of an illusion. Being a CEO isn’t an 8-5 job. And there are seasons when family is prioritized at the expense of work and work is prioritized at the expense of family. But my husband is an incredible partner. I couldn’t do it without his support "

You are married and have 2 kids, do you find difficult to have a balance between your personal and professional life? yes or no and why?

It is hard, because balance is a bit of an illusion. Being a CEO isn’t an 8-5 job. And there are seasons when the family is prioritized at the expense of work and work is prioritized at the expense of family. But my husband is an incredible partner. I couldn’t do it without his support. Whenever I have to focus on work, he’s always there to step into that gap. And I’m always there for him with his career.

What do you like to do in your spare time?

I love to play with my kids. They are my favorite hobby. I also love playing the piano, writing, and reading. I always want to learn something new.

What are your plans for this 2019?

We started our Affinity division this year, so my goal is to make that division as robust as we can for the sake of our advisors on the platform. I want them to know they made a great decision in joining us and that we are on their side. We want to be a tailwind to their success.

There is still the glass ceiling for women in the world: Fewer opportunities, jobs underpaid just for that fact of being a woman, etc. Have you experimented the glass ceiling? if yes, What are the biggest challenges you have faced and how have you overcome them?

My profession is dominated by men, so when I first began my career, I was often underestimated for being a young woman. I had to really fight to stand up for myself, gain a sense of confidence, and show that I could compete where male advisors typically were the de facto choice. When I lead investment teams, I have to show my value early and often. I had to become crystal clear on my value proposition and be able to say it with confidence.

" If I can’t spend time on this earth lifting other people up, what am I here for? I want to be an example to my kids that it’s not about us, it’s about how we can help others. And always be grateful"

What tips can you give to young girls who want to work in the financial sector?

It’s not easy but it’s incredibly rewarding, and we need you! Women are excellent financial advisors. We are good at listening, empathizing, and seeing problems in new ways. We find unique solutions. It’s a wonderful field and if you love working with people, this might be a great fit for you.

I think in your position, many people may have the wrong idea of who you really are (personally), and what do you (professionally), with this idea in mind, what is being Victoria and what's not?

This is a great question. I think people who don’t know me think that I have everything figured out. They think that I’m all put together and never have any bad days. But personally, I have insecurities, I do have bad days, and I question myself. Can I really live up to everyone’s expectations? The answer is no, and that’s okay. I’m only human.

Who is the woman you admire the most and why?

There are so many! I greatly admire the women I work with in my office because they are already defying the odds by being a part of this profession. They come in every day with energy, striving to help our clients day in and day out and to do it with such grace and expertise. They never cease to amaze me.

Name: Victoria Bogner

Sector: Financial

Company: McDaniel Knutson Financial & Affinity Financial Advisors

Designation: Chief Executive Officer

Country: The USA

Social media:

www.affinityfinancialadvisors.com